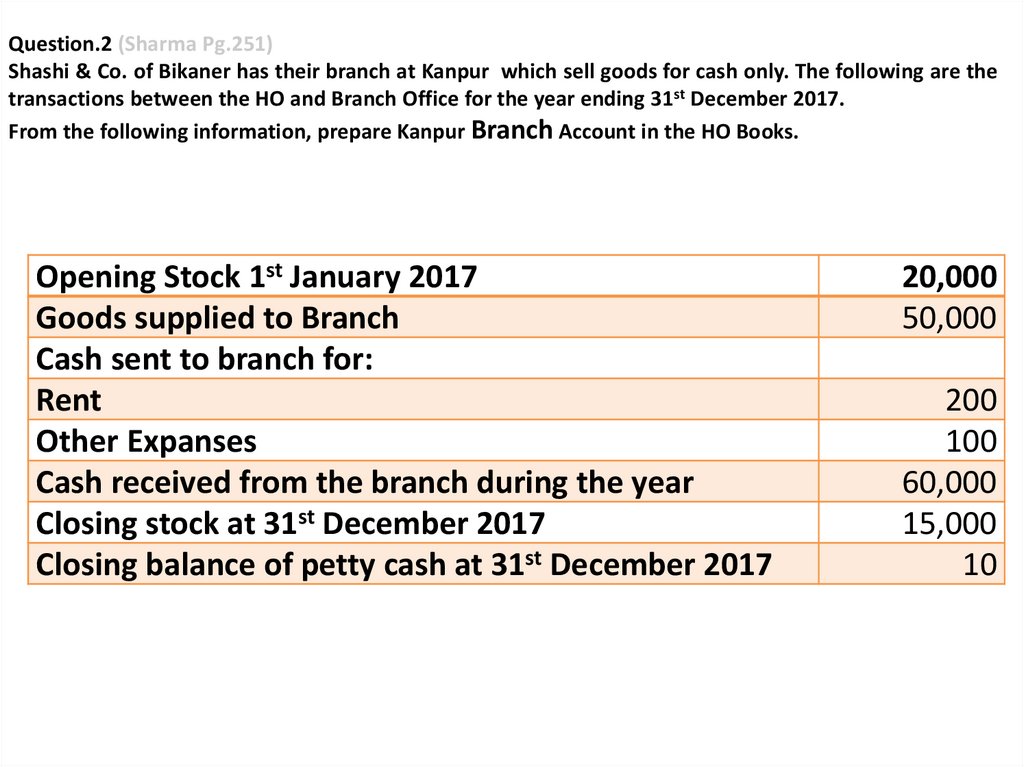

In accounting terms cash in transit is any item you record on your income statement that hasnt yet shown up on your bank statement. The above said entries remain in the books for a short period or till the arrival of cash in transit or goods.

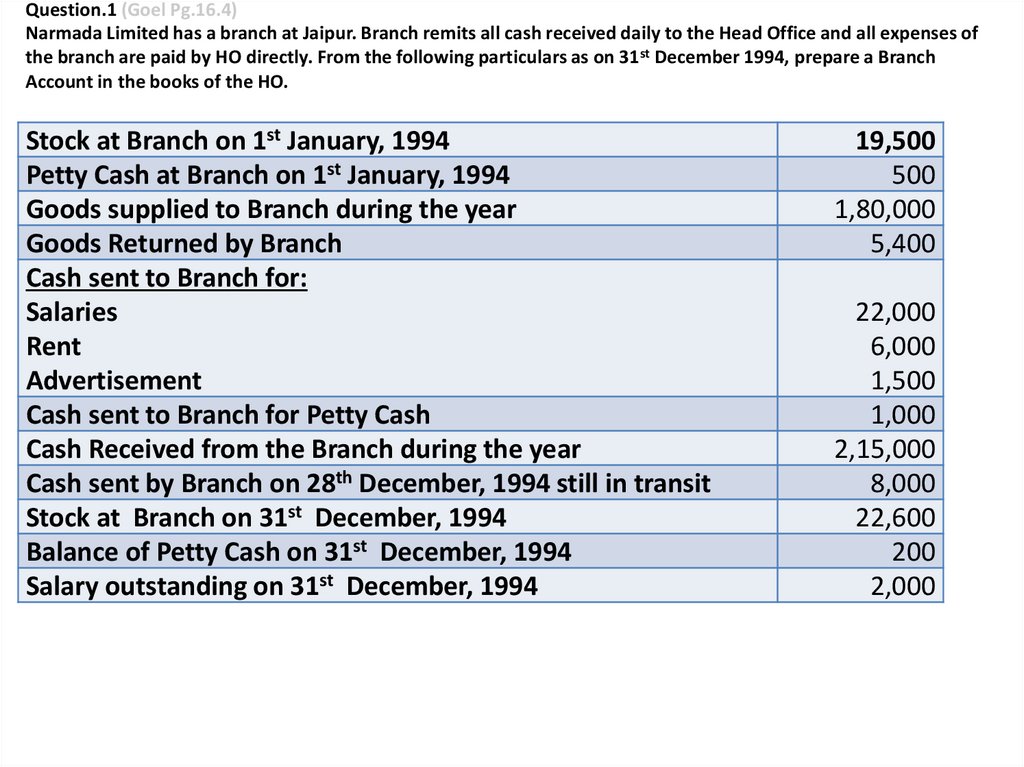

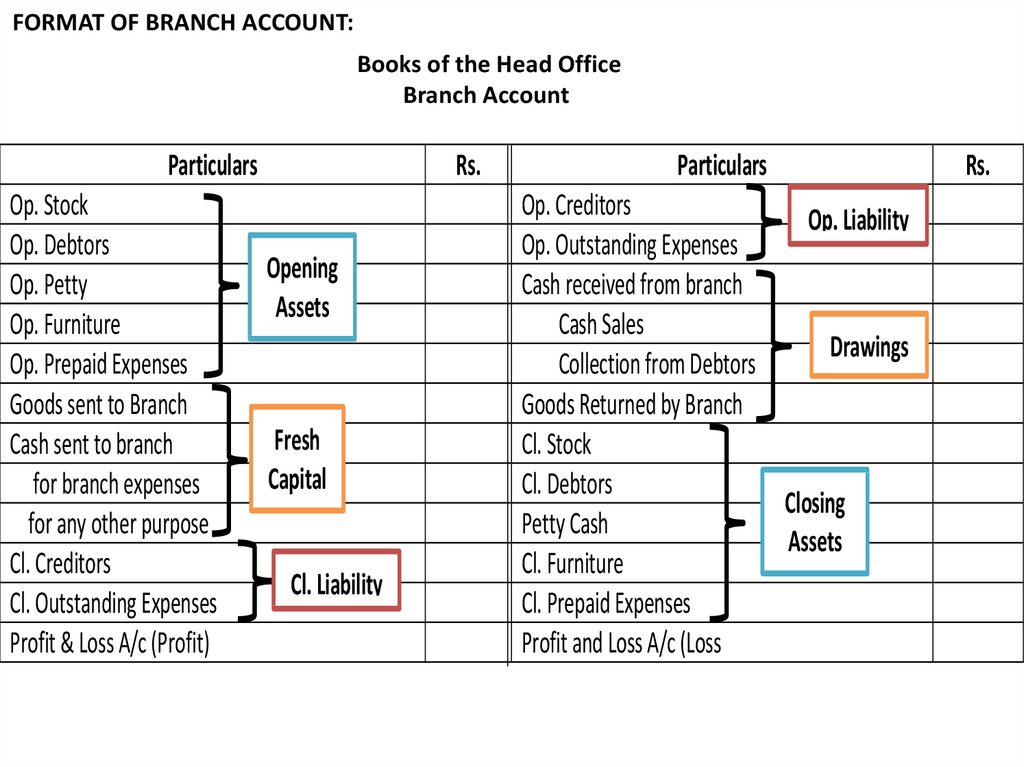

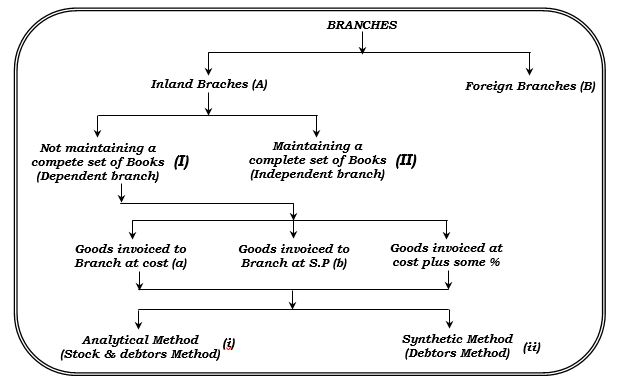

Accounting For Branches Online Presentation

Is it essential to show the cash in transit as part of the bank balance on the balance sheet.

Accounting Treatment Of Goods In Transit And Cash In Transit. Cash in transit adjusting entry is. OR show bank as 10000 to keep consistent with bank statement and show the 1000 as part of creditors and when the transaction comes into the. When forwarding agent sends shipping documents Invoice Bill of Lading or Air Way Bill by mail the stock in transit to be accounted for based on the shipping documents.

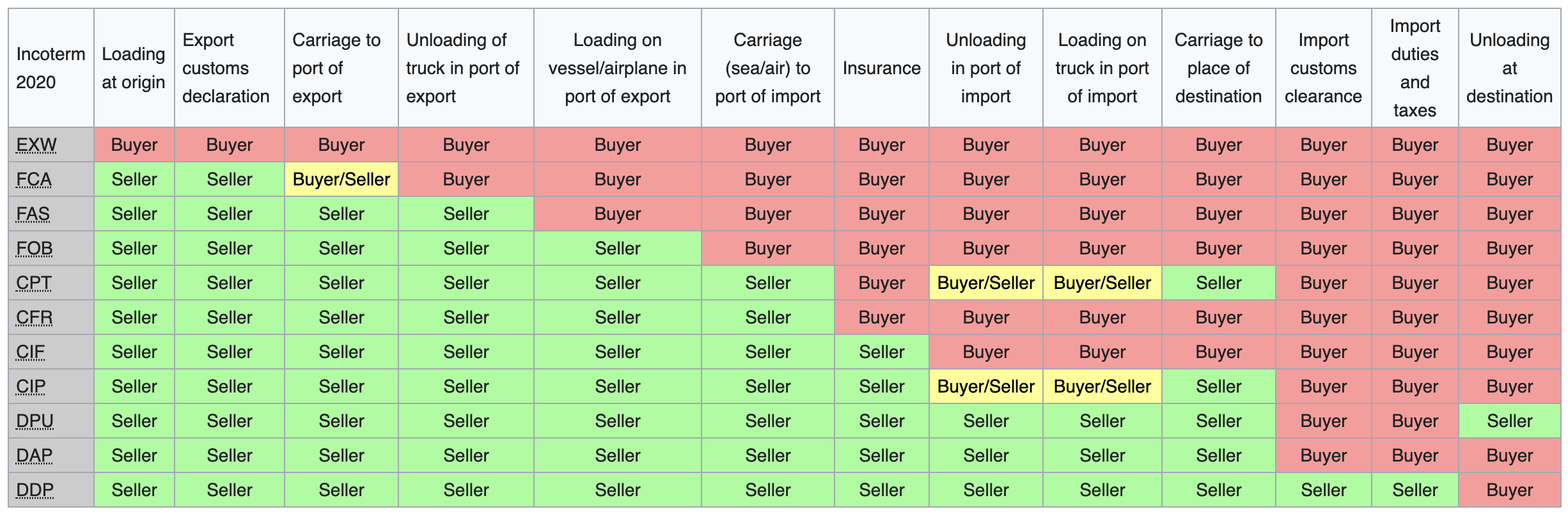

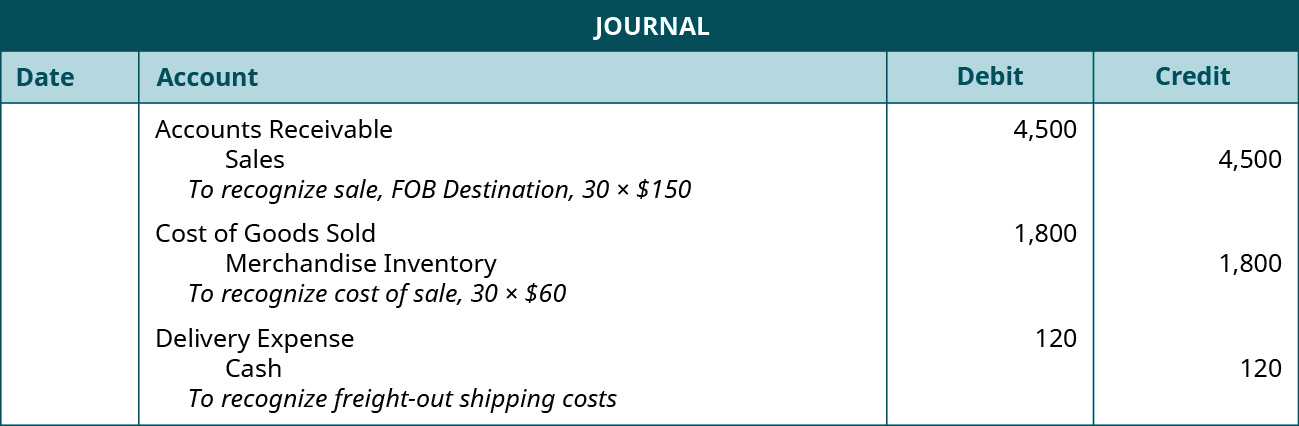

In accounting for goods in transit the main question is whether a sale has taken place resulting in. A check that is deposited but not recorded on the same day in the recipients bank account is controlled by the recipient and represents available funds and a demand on the customers bank account. If this is the case the seller records a sale and a receivable or cash and does not include the item in the ending inventory.

Accounting Treatment of Goods in Transit Goods in transit refer to inventory items and other products that have been shipped by a seller but have not yet reached the purchaser. However because of the cash in transit the 2 balances do not match. Cr Receivables current account.

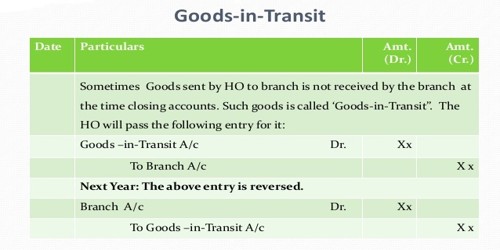

One company has 4000 and the other 10000. When the in-transit goods or cash is received by the recipient the entries made should be reversed and thus Transit Account is closed. Accounting Treatment of goods in transit In accounting for goods in transit the main question is whether a sale has taken place resulting in the passage of title to the buyer.

But the branch will record it when the goods are physically received by the branch. Consignees non-recurring expenses are not relevant for valuing the stock in transit because these goods. The wire transfer would not be a deposit in transit.

Consolidate the balance sheets of Big Ltd and Little Ltd which are shown on the next. Big sells its goods at a mark-up of 20. Goods in transit refers to inventory items and other products that have been shipped by a seller but have not yet reached the purchaser.

The term Goods in Transit or Transit inventory refers to inventory items that have been shipped by the seller but not yet received by the buyer. In order to consolidate the two companies we must eliminate the intercompany balance as not doing this will gross up the balance sheet and be misleading. The journal entry will be.

Free on Board FOB destination Ownership of goods is transferred when the goods arrive at destination. For example you may have logged a customer payment but the check is still clearing at the bank or you may have written a check for office expenses but the recipient hasnt cashed it yet. The deposited but not recorded check would be a deposit in transit.

Now the Current Accounts reconcile so reduce consolidated receivables and consolidated payables by the reconciled amount. Accounting Treatment Of Goods In Transit And Cash In Transit In Accounting For Branch Accounting Treatment Of Goods In Transit Normally the head office sends goods to the branch and it is immediately recorded by head office in its books. Show bank on BS as 9000.

If the goods or cash are in transit between P and S make the adjusting entry to the statement of financial position of the recipient. Goods in transit adjusting entry is. Accounting Treatment of Goods In Transit.

Accelerate the cash into the hands of the parent. GIT is booked in books of accounts on quarterly basis to ascertain true fair view of financial statements. Cr Payables current account.

There was cash of 5000 in transit from Little to Big. Ownership of goods in transit is determined by the terms of shipping agreement. When goods are in transit at the end of an accounting period they require special accounting attention since the goods are.

Cr Receivables the subsidiary receivable in the parents records 500. When goods or cash sent by the Branch are in transit the following entries are to be passed. Free on Board FOB shipping point Ownership of goods is transferred when the goods are on board at shipping point.

Transit inventory is an important component of companys inventory valuation. Big had sold 4000 of these goods before 31 December 20X3. During December 20X3 Little sold goods to Big for 20000.

Such goods must be valued by adding the proportionate non-recurring expenses paid by consignor to the original cost of the goods in transit. Dr Cash in transit. Little sells its goods at a mark-up of 25.

The goods dispatched to consignee may remain in transit on the last day of consignors accounting year.

Accounting For Branches Online Presentation

Accounting Treatment Of Goods In Transit Accountant Skills

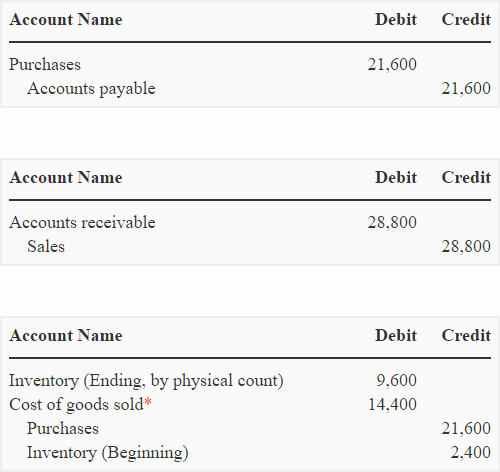

Periodic Inventory System Explanation Journal Entries Play Accounting

Accounting Treatment Of Goods In Transit Assignment Point

Acc 556 Week 5 Midterm Exam Part 2 Cost Of Goods Sold Inventory Turnover This Or That Questions

Ch09 Kieso Intermediate Accounting Solution Manual

Periodic Inventory System Explanation Journal Entries Example Accounting For Management

Ch08 Kieso Intermediate Accounting Solution Manual

Ch08 Kieso Intermediate Accounting Solution Manual

Accounting For Branches Online Presentation

Goods In Transit Meaning Examples Accounting Treatment

Accounting For Sales Return Journal Entry Example Accountinguide

Irrevocable Letter Of Credit Double Entry Bookkeeping

Accounting For Goods In Transit Example Accounting Accountinguide

Fob Accounting Double Entry Bookkeeping

Ch09 Kieso Intermediate Accounting Solution Manual

Discuss And Record Transactions Applying The Two Commonly Used Freight In Methods Principles Of Accounting Volume 1 Financial Accounting

Periodic Inventory System Explanation Journal Entries Play Accounting

0 Comments